How Much Life Insurance Do I Need At Age 65

Term life insurance of cash value life insurance. Age is one of several factors that affect how much you pay for life insurance.

Life Insurance Insurance Insurance Marketing

Most life insurance can be grouped into two main categories.

How much life insurance do i need at age 65. As you recall these policies are capped at 50000 of coverage so if you need more you need to go with a medical exam plan. Rule of thumb No. 20 Pay Whole Life.

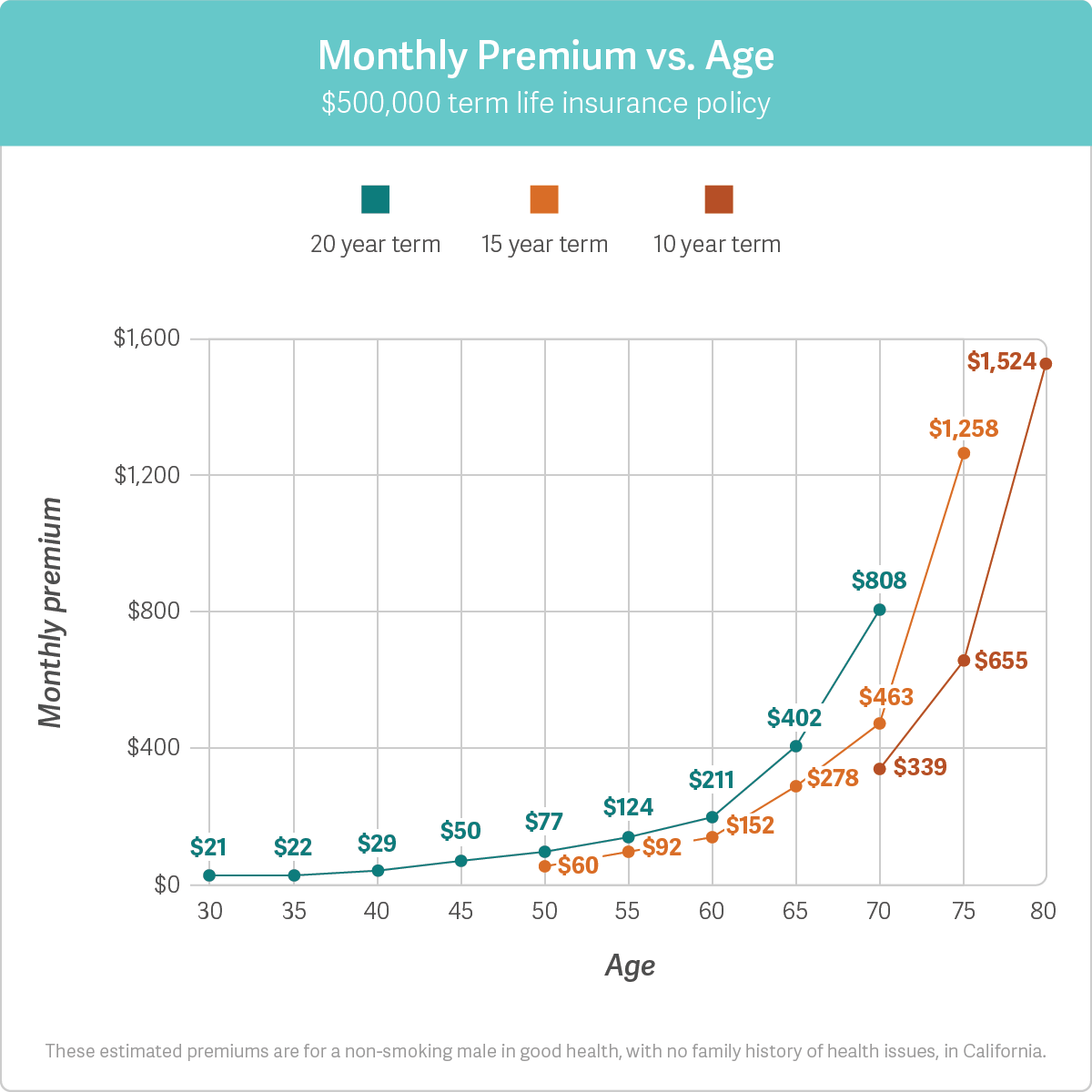

Best Life Insurance for Seniors over age 65. Premiums are very high for life insurance for seniors over 70 and if there is nothing to pay for after the person is longer around then the life insurance. Term life functions much like other forms of insurance.

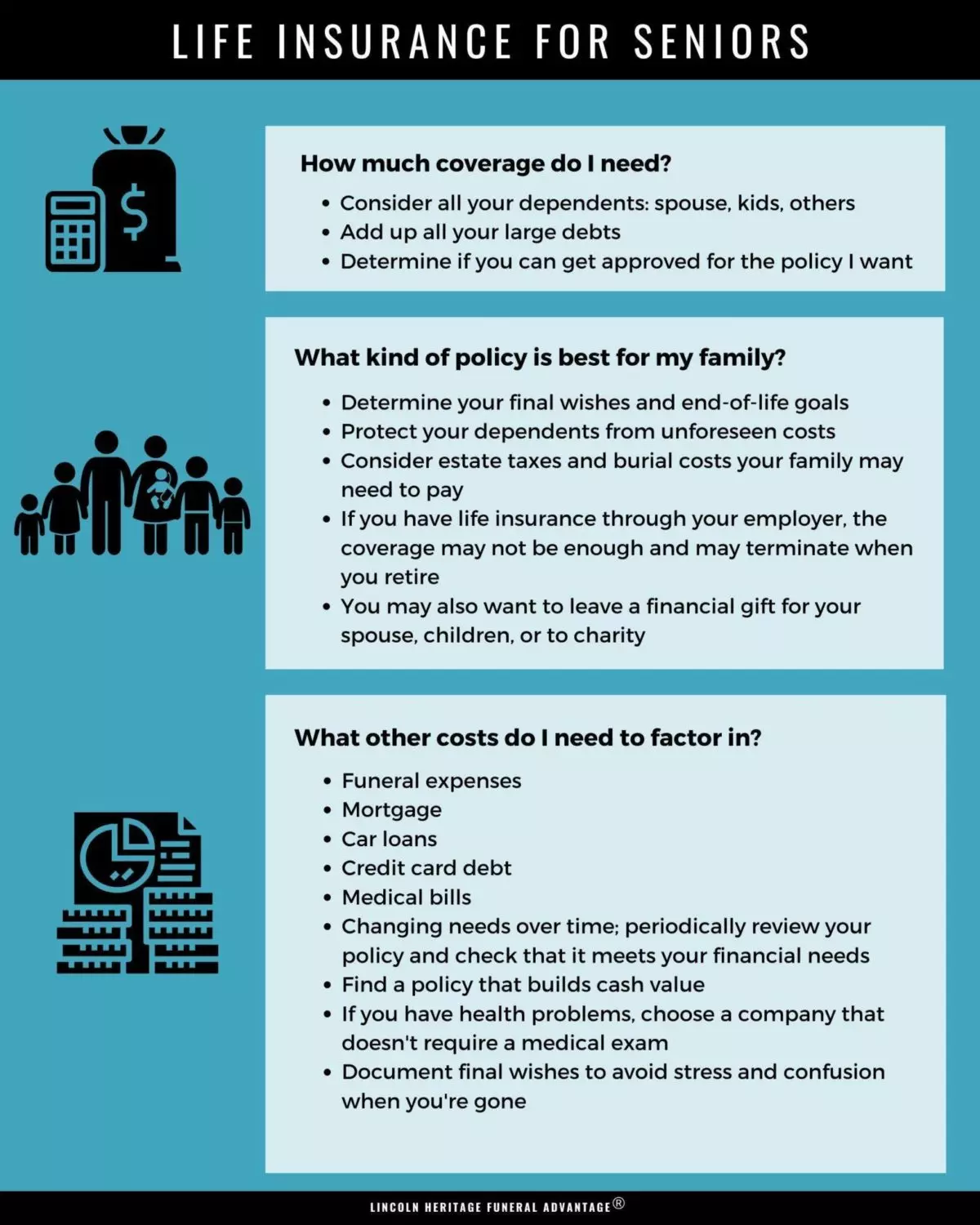

Choosing a Life Insurance Term Length The right term length is one that provides coverage while it is needed most. 32 of people age 70 and over were still making house payments in 2019. 10 Pay Whole Life.

The cost of a term life insurance policy at age 65 may not be as much as you think. As you can understand obtaining a 30 year term policy at your age might not be possible or you wont be able to afford it. If you are over the age of 65 and want a no exam policy then the only option left is really going to be a final expense whole life policy.

Generally the younger and healthier you are the lower your premiums will be. Rule of thumb. A 30-year term will provide the best value but may not be the right option given the situation.

Most companies nowadays offer whole life insurance to age 120 or age 121. Multiply your income by 10. Life insurance rates are influenced by.

The average person can expect to pay between 300 to 400 a year for life insurance. How much you pay depends on how much coverage you want the type of policy you get and how much risk you pose. You May Not Need Senior Life Insurance.

There are many types of life insurance that you can buy even over age 50. Here are a couple of examples. For the same reason broadly speaking most women in their 60s do not need to buy life insurance.

For official Government information about COVID-19 please visit wwwsacoronaviruscoza. Its not uncommon to need a 1000000 life insurance policy. If you are over sixty five years of age probably your best choice is to go with a 10 year term or 15 year level term insurance policy.

This premium increases significantly depending on age so expect to pay nearly double that average at the age of 65 and nearly triple at the age of 70. For example if youre a 25-year-old nonsmoking male in excellent health a 30-year term life policy for 500000 of coverage could cost you 2823 per month. After considering your circumstances you may decide you do not have to carry life insurance.

Life insurance rates for ages 60 to 70 The average cost of life insurance for a 500000 20-year term policy is 22863 for a 60-year-old man and 16288 for a 60-year-old woman. Limited Pay Whole Life Insurance. Use the calculator above to get a more refined idea of how much life insurance you need then compare that value to these estimates.

Most financial planners recommend an amount 10-15x your current income. Choose An Amount For Your Life Insurance Policy. A healthy 60-year-old can qualify for 100000 of life insurance with a 20-year term for between 38 and 52 per month according to Quotacy.

A 65-year-old woman in good health looking for a 20-year term worth 100000 is likely to be offered. The OUTsurance Life insurance calculator will help calculate how much Life cover you would need to ensure you and your family are financially taken care of. In fact a 2018 report stated that 46 of homeowners age 65 and older still carried a mortgage.

With limited pay life insurance you pay into the policy for an abbreviated period of time. When choosing a term length consider your age and insurance needs. Whole Life to Age 65.

There are different options available including. You have an annual premium and as long as you pay it you have life insurance. According to financial expert Suze Orman it is ok to have a life insurance policy in place until you are 65 but after that you should be earning income from pensions and savings.

Am I Too Old To Buy Life Insurance Policygenius

Life Insurance Over 70 How To Find The Right Coverage

Term Vs Whole Life Insurance Policygenius

Wealth Protection Are You Prepared For A Life Threatening Event

Protect Yourself While Building Your Future Learn More Pm For Your Free Sunlife Financial Pl Life Insurance Quotes Commercial Insurance Sun Life Financial

Pin By Alex Tevis On Retirement Life Insurance Facts Life Insurance Quotes Life And Health Insurance

2021 Final Expense Life Insurance Guide Costs For Seniors

How Much Life Insurance Do You Need Forbes Advisor

Life Insurance Over 70 How To Find The Right Coverage

How Does Whole Life Insurance Work Costs Types Faqs

Do You Want To Be Part Of The 2 The Answer To This Is Proper Financial Planning And R Life Insurance Quotes Term Life Insurance Quotes Life Insurance Facts

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Bar Chart Explaining How Different Types And Amounts Of Life Insurance Can Help You At Different Times Throughout Yo Wealth Management Life Insurance Insurance

Try These Tips To Save Money On A Life Insurance Policy Buy Life Insurance Online Life Insurance Policy Medical Insurance

Best Life Insurance For Seniors

When Is The Best Time To Buy Life Insurance Insurance Investments Life Insurance Insurance

Do You Still Need Life Insurance Over 60 Sixty And Me

0 Response to "How Much Life Insurance Do I Need At Age 65"

Post a Comment